health insurance for your pets: smarter coverage choices

After a year of renewals and a few claims, I've learned to care less about slogans and more about how fast money comes back and what actually gets reimbursed.

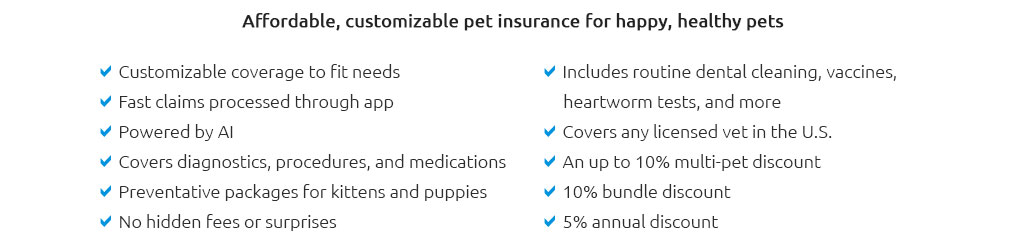

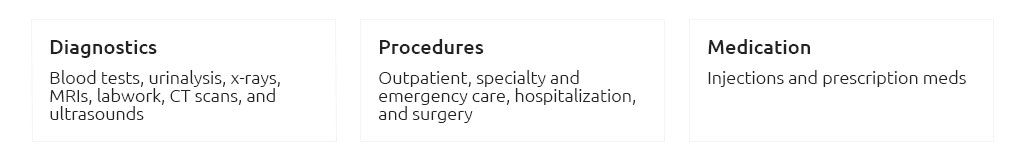

What it actually covers

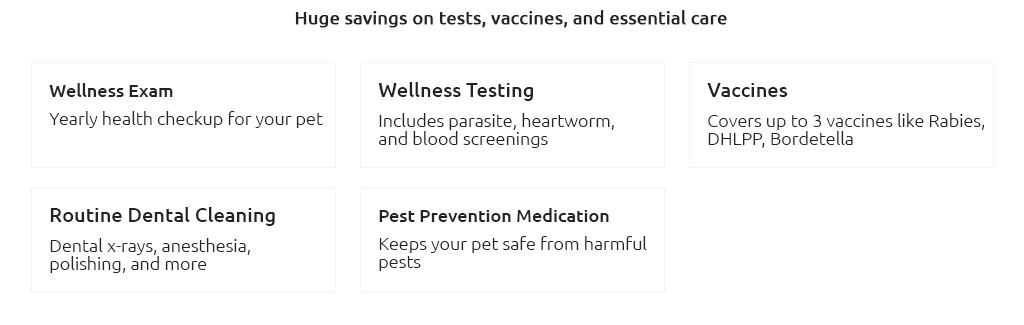

Policies center on accidents and illnesses. Wellness add-ons exist, but they're budgeting tools, not insurance.

- Accidents: bites, fractures, swallowed toys.

- Illnesses: infections, GI upsets, long-term issues like diabetes.

- Hereditary and congenital: often included if there were no signs before enrollment.

- Diagnostics: X-rays, ultrasound, bloodwork - covered when tied to a covered event.

- Medications and hospitalization: subject to your deductible and co-pay.

- Dental trauma: usually yes; routine cleanings typically separate.

- Rehab/alternative: PT or acupuncture may need a rider.

Realistic check: waiting periods, bilateral condition rules, and per-incident vs annual deductibles change real costs more than glossy examples.

How plans pay you

Most reimburse you: pay the vet, submit a claim, get money back. That flow matters for cash planning.

- Meet the annual deductible (e.g., $250).

- Apply reimbursement (commonly 70 - 90%).

- Watch the annual limit - once hit, you pay the rest.

Quick math: a $1,800 GI workup with a $250 deductible at 80% returns roughly $1,240 to you.

Real moment: last winter, I uploaded my cat's ER invoice from the parking lot on a Sunday; three days later the reimbursement landed in my account.

Cost levers that matter

- Breed and age: higher-risk breeds and seniors cost more.

- ZIP code: big-city care is pricier, premiums follow.

- Deductible: higher deductible, lower premium - pick an amount you can pay today.

- Reimbursement %: 70% is efficient; 90% smooths spikes but costs more.

- Annual limit: 5k, 10k, or unlimited - match to your area's surgery costs.

- Wellness add-ons: compare fees to what you already spend.

Feature breakdown, quickly

- Direct pay to vet: rare but excellent; ask if your clinic supports it.

- Exam fees: not always covered; affects sick visits.

- 24/7 tele-vet: can prevent unnecessary ER trips.

- Prescription food/supplements: often excluded or capped.

- Behavioral therapy: coverage varies and may require a diagnosis.

- Dental disease: separate from trauma; rules differ widely.

Efficient comparison habits

I keep last year's invoices and test plans against real bills. It trims noise fast.

- List age, breed, and any prior issues.

- Define must-haves: hereditary coverage, exam fees, rehab.

- Choose a deductible you won't blink at in an emergency.

- Run two scenarios: $1,200 GI flare and $5,000 surgery; compare out-of-pocket.

- Read sample policy exclusions: cruciate waits, dental disease, bilateral rules.

- Check claim submission options and typical payout times.

- See how renewals treat chronic conditions and premium increases.

Edge cases to check before you commit

- Pre-existing: "curable" vs "incurable" definitions vary by insurer.

- Orthopedic waivers: some need a vet exam to shorten long waits.

- Bilateral conditions: one knee today may exclude the other.

- Referral requirements: specialists may require GP referrals.

- Travel coverage: out-of-state or international rules differ.

- Aging: expect premium bumps after 8+ years; adjust your budget.

Is it worth it?

For me, yes - it buys choice. I approve diagnostics without second-guessing. The trade-off is a steady bill that creeps up. If you're disciplined with a self-funded emergency stash, that's a sensible route too. Otherwise, pick a simple, sustainable plan you can keep long term so coverage is there before you need it.